When it comes to home financing, one size doesn’t fit all. If you plan to stay in your home — or keep your mortgage — for 7 years or less, an Adjustable-Rate Mortgage (ARM) might be worth considering.

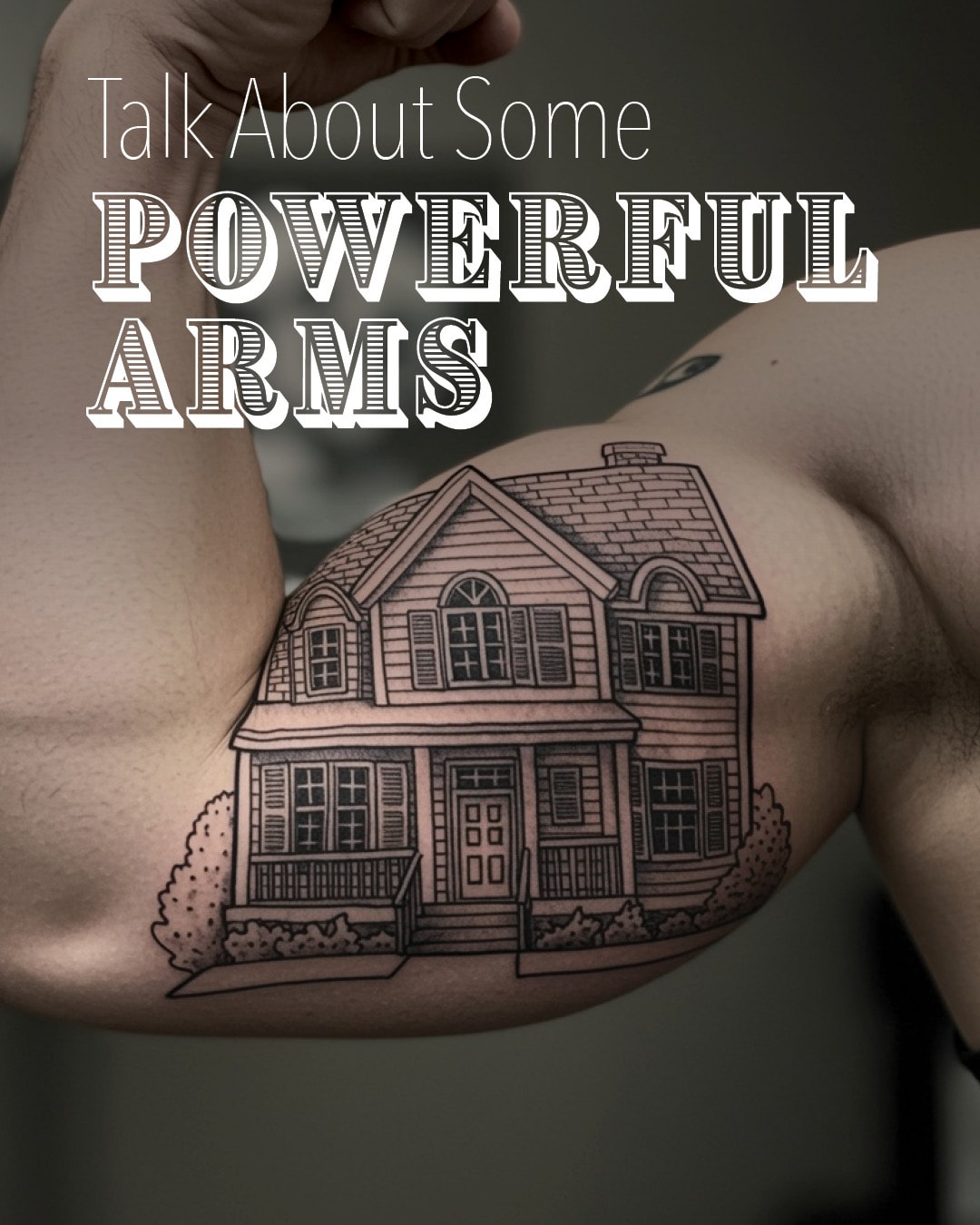

Why ARMs Can Be Powerful

An ARM typically starts with a lower interest rate than a fixed-rate mortgage. That lower rate can mean smaller monthly payments, giving you more breathing room in your budget. This can be especially helpful if you want to:

- Save for other investments or life goals

- Pay down higher-interest debt

- Enjoy more financial flexibility in the short term

How It Works

With an ARM, your interest rate is fixed for an initial period (commonly 5, 7, or 10 years). After that, the rate can adjust annually based on market conditions. If you sell, refinance, or pay off your home before that initial fixed period ends, you can take advantage of the lower starting rate without ever facing an adjustment.

Is It the Right Fit?

ARMs aren’t for everyone, but they can be a great tool if you have a clear plan for your homeownership timeline. Whether you’re buying your first home, moving up, or planning a relocation in the near future, I can help you run the numbers to see if an ARM makes sense for you.

📞 Call me at 206-949-5563 or visit www.YourMortgageCopilot.com to explore your mortgage options today. ✈️

No responses yet