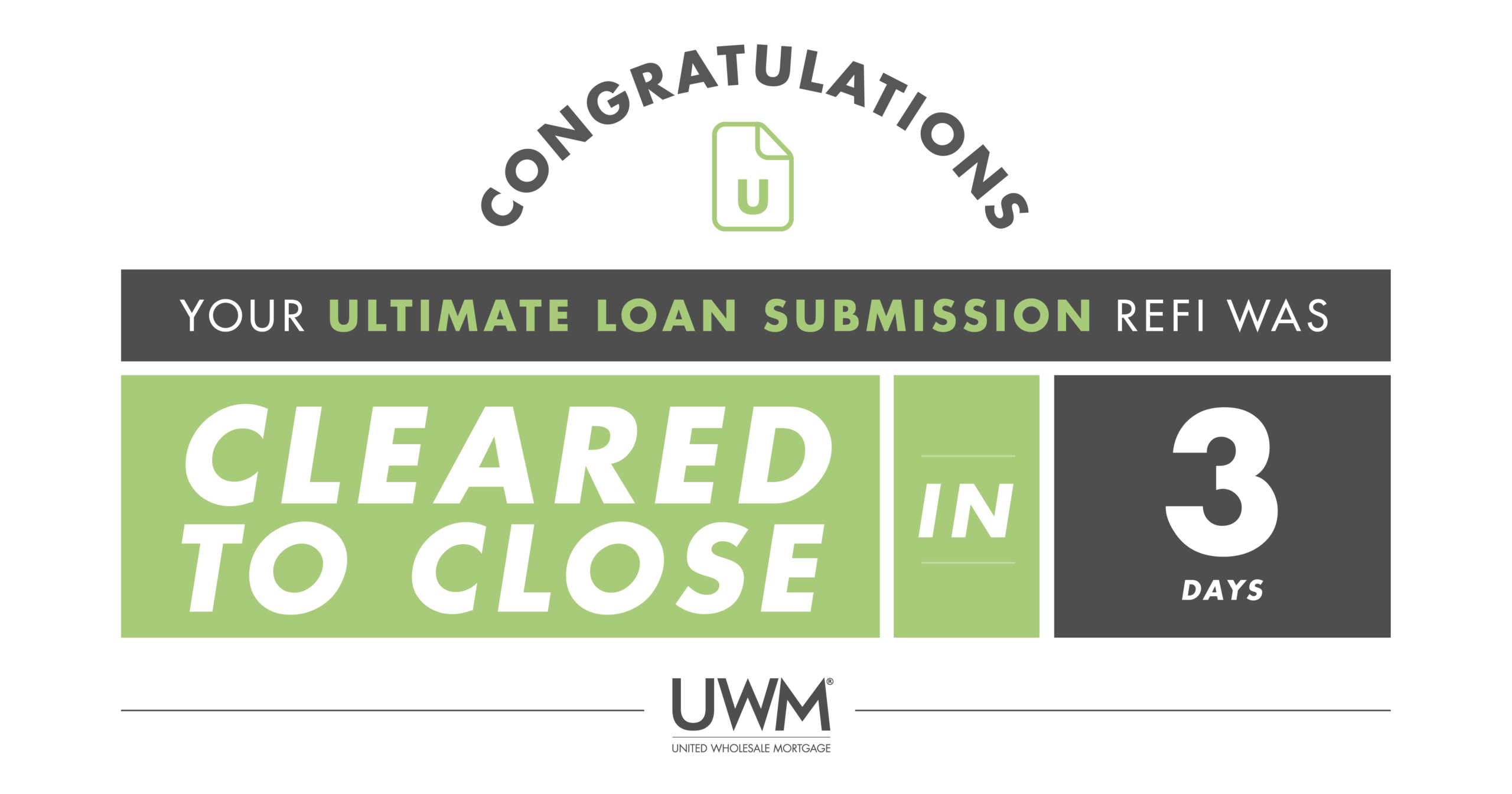

Every once in a while, a refinance comes together so efficiently that the only thing slowing it down is federal consumer protection rules. This was one of those cases.

This recent refinance was cleared to close in just three business days, despite requiring a full appraisal. That kind of timeline doesn’t happen by accident — it’s the result of strong borrower preparation, clear communication, and the right lending partners working in sync.

So why aren’t we closing immediately?

A Quick Word on the 7-Day TRID Rule

Federal TRID regulations require borrowers to receive their Closing Disclosure at least seven days before closing. Even when a loan is fully approved and ready to go, this waiting period is mandatory.

In this case, the loan was ready far earlier than required — which means we simply wait until Friday to sign. That’s not a delay; it’s the system working exactly as designed to protect the borrower.

Why This Matters

Fast approvals don’t just feel good — they matter when:

- Locking in time-sensitive rates

- Coordinating appraisals and underwriting efficiently

- Reducing stress and uncertainty for homeowners

Speed is only valuable when it’s paired with accuracy and transparency. My goal is always to move quickly without cutting corners, while keeping clients informed every step of the way.

If you’re thinking about refinancing and want to understand what timelines are realistic — and what’s possible with the right setup — I’m happy to help.

Call or text 206-949-5563

Visit www.YourMortgageCopilot.com ✈️

No responses yet