When buying a home, most people focus on price, location, and interest rates. But the type of mortgage you choose can have just as much impact on your long-term financial success.

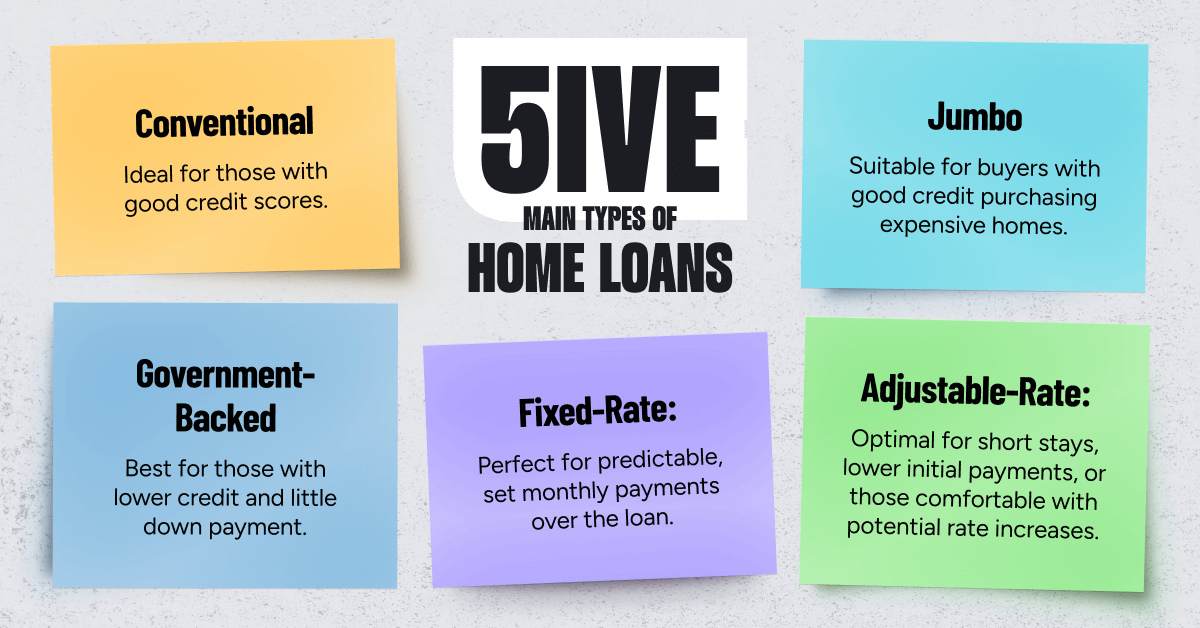

Here’s a straightforward breakdown of the five main types of home loans and who they’re best suited for.

1. Conventional Loans

Conventional loans are one of the most common mortgage options. They typically work best for borrowers with:

- Strong credit scores

- Stable income

- Solid down payment savings

They often offer competitive interest rates and flexible terms. For financially strong borrowers, this is frequently the most cost-effective option.

2. Government-Backed Loans (FHA, VA, USDA)

These loans are backed by federal programs and are designed to make homeownership more accessible.

- FHA loans allow lower credit scores and smaller down payments.

- VA loans offer exceptional benefits for eligible veterans and active-duty service members.

- USDA loans support home purchases in qualifying rural areas.

These can be excellent options if you need flexibility with credit or down payment.

3. Jumbo Loans

Jumbo loans are used when a home’s price exceeds the conforming loan limit.

In 2026, the conforming limit for most areas is $832,750. Homes priced above that amount typically require jumbo financing.

These loans generally require:

- Strong credit

- Larger down payments

- Strong income documentation

They’re common in higher-priced markets.

4. Adjustable-Rate Mortgages (ARMs)

ARMs start with a lower fixed rate for an initial period (such as 5, 7, or 10 years), then adjust periodically based on market conditions.

They can make sense for:

- Buyers planning to move within a few years

- Borrowers comfortable with some future rate uncertainty

- Those wanting lower initial monthly payments

The key is having a clear strategy before the adjustment period begins.

5. Fixed-Rate Mortgages

With a fixed-rate mortgage, your interest rate and principal payment never change.

This option offers:

- Stability

- Predictable budgeting

- Long-term security

For buyers planning to stay in their home long term, this is often the simplest and most comfortable solution.

The Right Loan Depends on Your Plan

There isn’t one “best” mortgage — only the best mortgage for your situation.

Your timeline, financial goals, risk tolerance, and property type all matter.

If you’re considering buying or refinancing, I’d be happy to walk you through your options and help you build a smart, strategic plan.

— Elliott Bowman

Your Mortgage Copilot

(206) 949-5563

www.YourMortgageCopilot.com

No responses yet