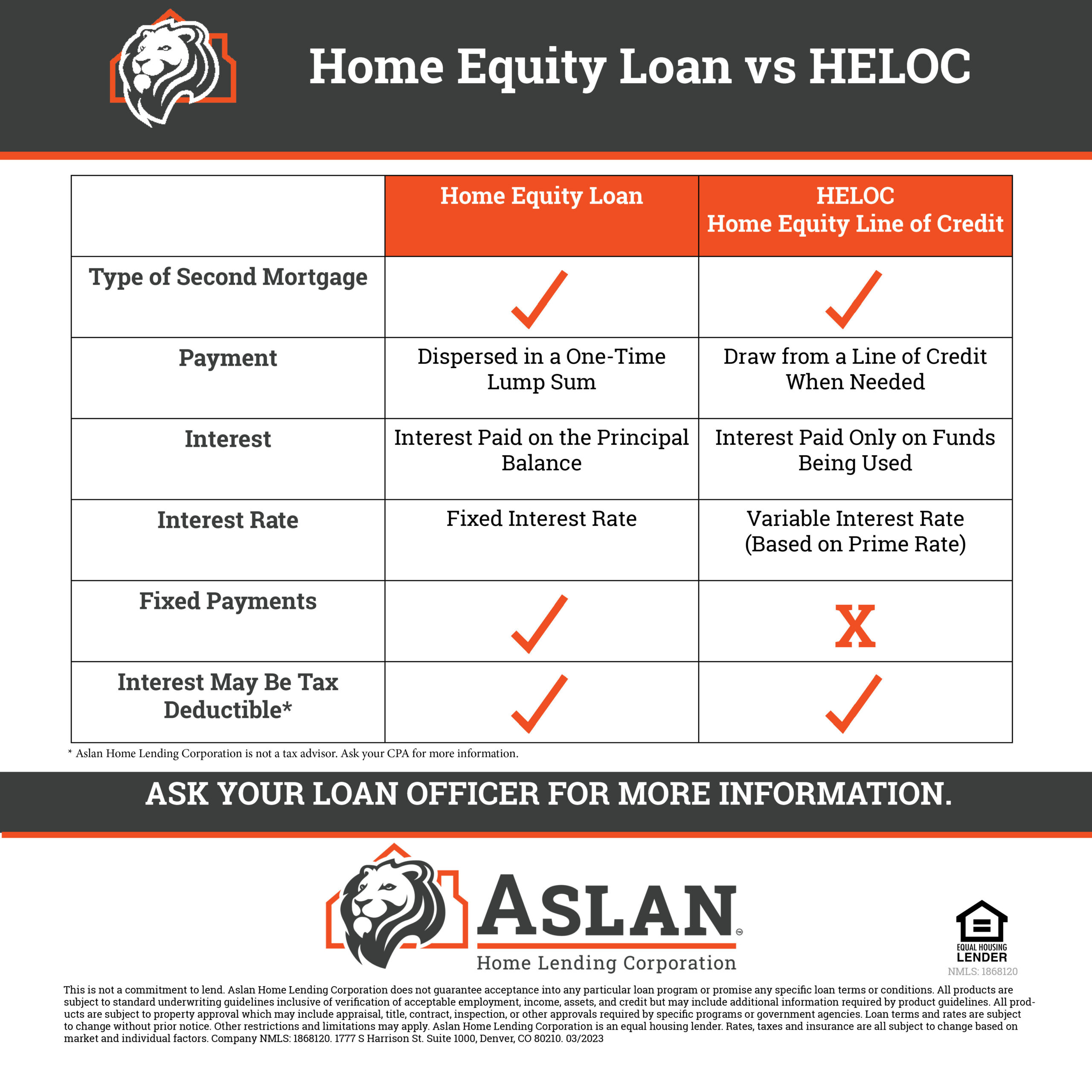

A home equity loan, also known as a second mortgage, is a one-time lump sum loan that is secured by your home. The loan amount is based on the equity you have built up in your home, which is the difference between the current market value of your home and the amount you still owe on your mortgage. Home equity loans typically have a fixed interest rate and a set repayment term, which can range from 5 to 30 years.

A home equity line of credit (HELOC), on the other hand, is a revolving line of credit that also uses your home as collateral. With a HELOC, you can borrow up to a certain amount of money, which is determined by the equity in your home. You can borrow and repay the funds as needed, much like a credit card, and you only pay interest on the amount you borrow. HELOCs typically have variable interest rates, which can fluctuate over time, and they usually have a draw period of 5 to 10 years, during which you can borrow funds, followed by a repayment period.

The choice between a home equity loan and a HELOC will depend on your individual needs and financial situation. If you need a one-time lump sum of money and prefer a fixed interest rate and predictable payments, a home equity loan may be the better option. However, if you need access to a line of credit that you can draw on as needed and prefer a variable interest rate, a HELOC may be more suitable. It’s important to speak with a loan officer who can help you understand the specific terms, interest rates, and repayment options for each type of loan to make an informed decision.

No responses yet