Dreaming of becoming a homeowner? The first step on your journey to homeownership is to begin the pre-approval process. A mortgage pre-approval is an important step that provides you with a clear understanding of your budget and enhances your credibility as a serious buyer. In this article, we will walk you through the factors that go into gaining a pre-approval letter, empowering you to take the necessary steps towards securing your dream home.

Understanding the Pre-Approval Process: The pre-approval process involves an evaluation of your financial situation by a lender to determine the loan amount you may qualify for. Here are the essential steps to obtain a mortgage pre-approval:

- Gather Financial Documents: To start the pre-approval process, you’ll need to gather essential financial documents. These typically include recent pay stubs, W-2 forms, tax returns, bank statements, and any other documentation related to your income, assets, and debts. Having these documents organized and readily available will help streamline the pre-approval process.

- Credit Check: Lenders will assess your creditworthiness by pulling your credit report and reviewing your credit score. A good credit score demonstrates your ability to manage debt responsibly and increases your chances of securing a favorable pre-approval.

- Provide Detailed Information: During the pre-approval process, you’ll be required to provide detailed information about your employment history, income, and monthly expenses. The lender will use this information to assess your financial stability and determine the loan amount you may qualify for.

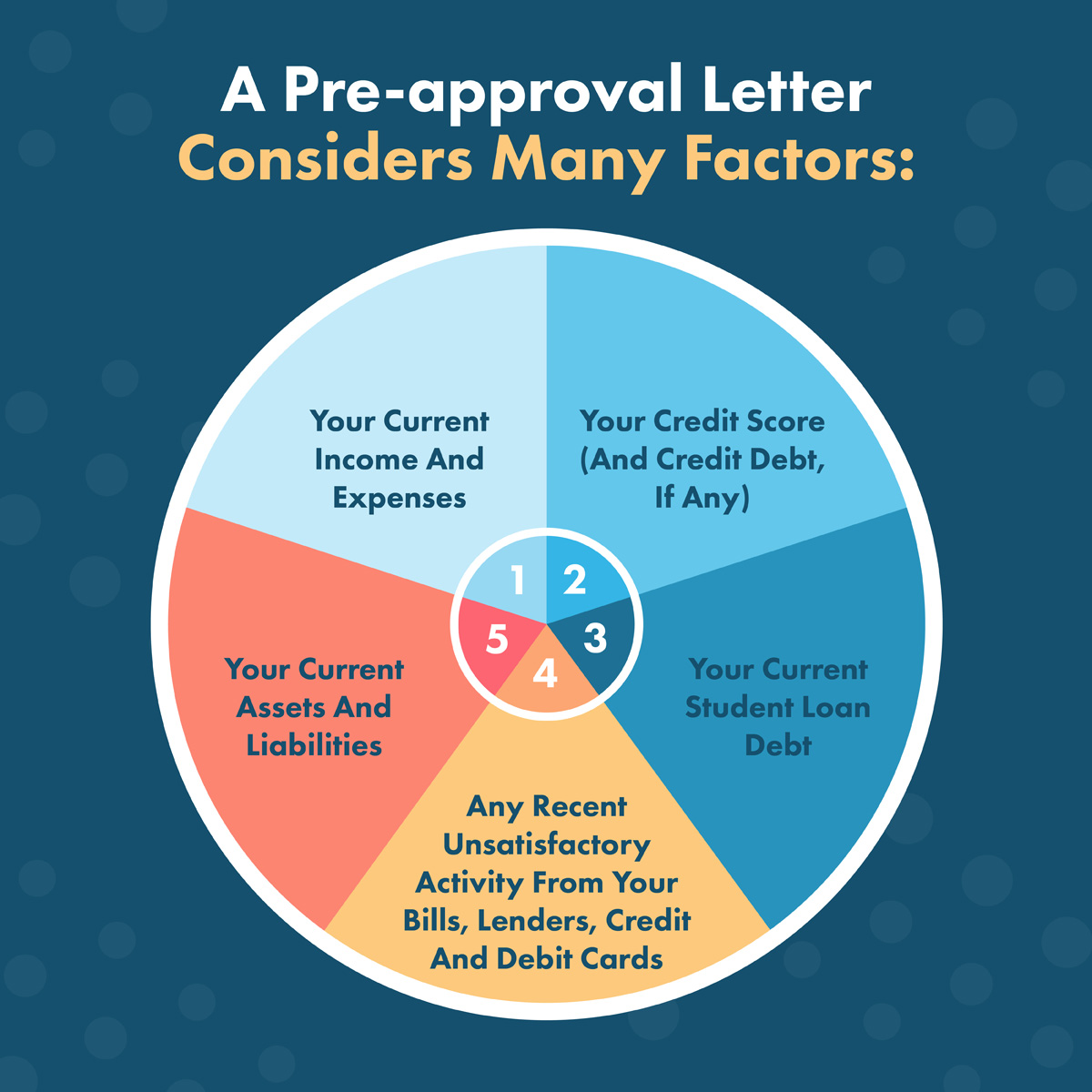

- Verification and Evaluation: Once you’ve provided the necessary documentation and information, the lender will verify your details and evaluate your financial situation. This involves analyzing your income, debt-to-income ratio, credit history, and other factors to determine your eligibility for a pre-approval.

- Receive the Pre-Approval Letter: If your financial situation meets the lender’s criteria, you will receive a pre-approval letter. This letter outlines the loan amount you are pre-approved for and provides you with the confidence and credibility needed when making an offer on a home.

Why Pre-Approval Matters: Obtaining a pre-approval letter is beneficial for several reasons:

- Budget Clarity: A pre-approval gives you a clear understanding of your budget and the price range of homes you can afford. This helps you focus your search and saves time by targeting properties within your financial capabilities.

- Enhanced Negotiating Power: Sellers are more likely to consider offers from buyers with pre-approvals as it demonstrates their seriousness and financial readiness. Having a pre-approval can give you a competitive edge in a competitive housing market.

- Expedited Loan Process: Once you find your dream home and make an offer, having a pre-approval can expedite the loan approval process. The lender has already evaluated your financials, making the final loan approval smoother and quicker.

The journey towards homeownership begins with a mortgage pre-approval. It provides you with a solid foundation, clarity on your budget, and increased credibility in the eyes of sellers. When you’re ready to take the next step and secure a pre-approval, reach out to us. Our experienced team at [Your Mortgage Copilot] is ready to guide you through the process, ensuring you have the necessary tools to make informed decisions on your path to homeownership. Call us today and let’s get started on turning your homeownership dreams into a reality!

No responses yet